The role of a CFO is evolving. It was once common to be knee-deep in spreadsheets for most of your working day, but now, savvy finance managers run their company’s fiscal data with a suite of specialized tools.

The software you choose has a huge impact on your working life. It can be the difference between overworking on frustrating admin tasks, and automating the dull parts of your job to focus on strategy and innovation.

According to Cledara’s database of software purchasing stats, the tools on this list have proved enduringly popular with finance teams. Read on to understand what they are, and how they can help you.

The Top 10 CFO software tools**

In no particular order, here are some of the industry’s most popular subscriptions for finance managers.

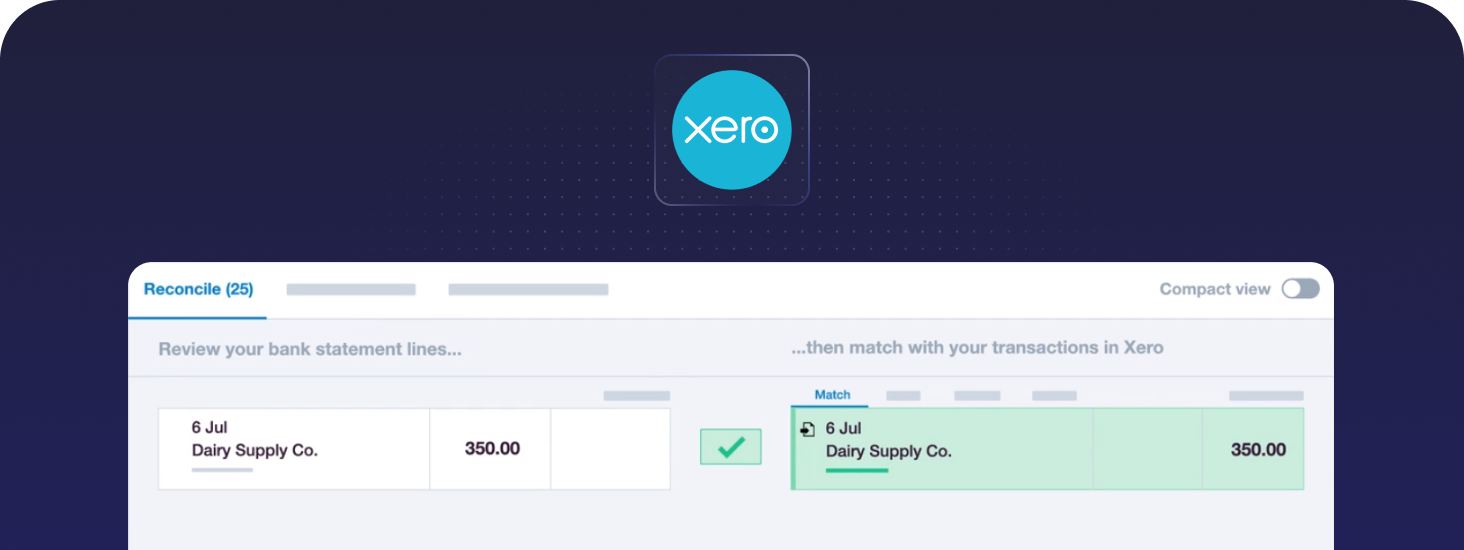

1. Xero

Main function: Cloud-based accounting software

You’ve almost certainly heard of Xero. It’s a cloud-based accounting software that can help you keep track of your business’ financial processes and data. It’s mainly used by businesses on the smaller side. It offers features to help with:

- Financial management—there’s a dashboard to provide a quick overview of your finances, so you can see how much cash is in your business coffers and whether it’s enough to pay upcoming bills.

- Invoicing—you can raise invoices with your customers faster, and save products and services you use regularly as inventory items.

- Bookkeeping—there’s a bank reconciliation feature where you can match up entries from your bank statement to invoices.

- Financial reporting—you can create financial reports on previous spend and short term cash-flow predictions.

- Taxes—in some regions, Xero offers the opportunity to file tax and payroll information with your local tax agency.

A great alternative: Quickbooks deserves an honorable mention here. It’s another accounting software package which offers many of the same features, and which many CFOs of small-to-medium-sized businesses swear by. Here's our comparison of Xero and Quickbooks, if you're struggling to choose.

2. Cledara

Main function: Software management

If your company uses a lot of software, managing subscriptions can be a huge headache. Manually calculating the ROI on tech is a frustrating task with goalposts that move every month, as teams pick up new subscriptions and forget about old ones. Who knows what you’re really paying for software?—Let alone how to reduce these costs.

Cledara helps you keep track of your software tools, and pay for them in a secure and time-efficient way. It gives you a dashboard to show all your software spend in one place—and can typically help you reduce it by 30%, almost overnight.

Cledara offers:

- A dashboard that shows you all your subscriptions in one place. This means you can easily renew, change or remove software subscriptions in one place, as well as being able to forecast software costs.

- A feature that shows you how much teams use each tool so you can spot duplicate or unused subscriptions, and cancel them.

- A process to pay for tech subscriptions that’s secure, simple, and means you can limit your spend for each tool.

- An invoice matching feature that connects your invoices to the corresponding software subscription automatically, saving you hours of bookkeeping time.

You’ll uncover so many opportunities to trim your software spend that customers say the tool pays for itself.

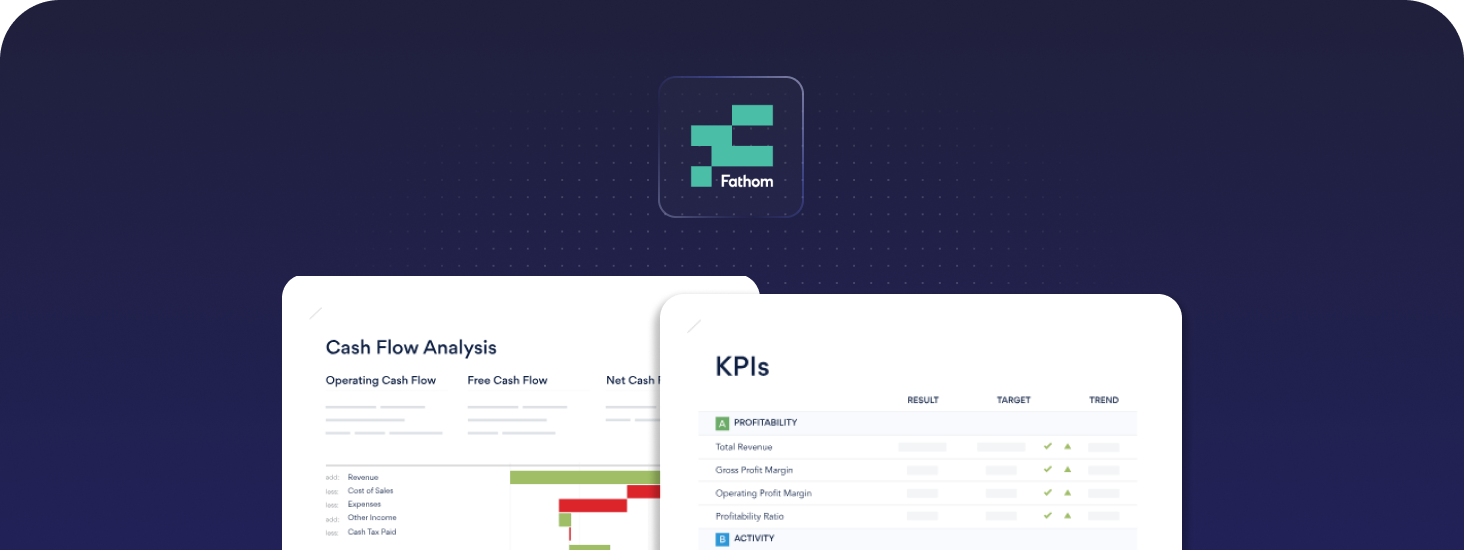

3. Fathom

Main function: Financial analytics platform

A huge part of the role of CFO is in communicating information about the financial health of the company to other stakeholders. Fathom is a trusted tool for this task. The financial analytics platform allows you to:

- Create visualizations of trends in your company’s financial data, so you’re not rooting around for patterns in spreadsheets.

- Predict your business’ financial performance and cash flow for the next financial period.

- Analyze key metrics such as your KPI performance, profit and growth, and compare them to data from industry benchmarks.

4. Chaser

Main function: Accounts receivable automation

Chaser, as its name suggests, is primarily a tool for chasing unpaid invoices. If you often spend precious working hours sending “gentle reminders” to late customers, or struggle to monitor who has paid what, this is definitely a subscription you’re missing.

Chaser allows you to:

- Synch incoming invoices with your accounting system, so payments are automatically reconciled.

- Send out pre-written payment reminder emails on a custom schedule, both before an invoice is due and when it's overdue, including a “Pay Now” button to simplify the payment process.

- Create a dedicated payment portal for your customers, where they can see what they owe you and what they’ve already paid, as well as make payments.

- Access a debt collection service, if things get out of hand.

5. Dext

Main function: Receipt data extraction

Dext offers a whole suite of tools to automate your accounting, but it’s best loved as a way to automatically extract data from receipts. For CFOs, this erases a whole host of dull data entry tasks. Dext allows you to:

- Scan receipts with a mobile app, and send the information automatically to your accounting software.

- Email digital receipts to a dedicated address which scans them, and send the information to your accounting software.

6. Carta

Main function: Cap table management

Carta is a platform for managing your cap table, or capitalization table: the document that tracks ownership of your company. When your business grows, you’ll start to issue equity to employees, investors and advisors—each on different terms.

Many businesses’ first cap table is a humble spreadsheet, but it can become difficult to understand the whole picture of who owns what. Carta is a platform to centralize this information before it gets out of hand. It gives you:

- The chance to get company valuations and growth-share valuations by in-house experts in 3 to 5 days.

- A source of truth for cap table information, saving you thousands on legal fees to reconcile different versions.

- Built-in features to check your share plan is compliant with local tax laws.

7. ApprovalMax

Main function: Expense approval management

ApprovalMax can help streamline your expense approval processes, so that your team can buy what they need to do their job quickly and easily. It allows you to:

- Set up custom approval chains so those in charge of budgets get a notification every time their subordinates make a purchase—allowing them to grant approval with a button click.

- Create custom reports on your company's expenses and bills.

- Automatically send your expense information to popular accounting platforms like Xero, Netsuite and Quickbooks.

8. Joiin

Main function: Financial reporting

As you might guess from the size of this list, most companies' financial data is spread out across a range of platforms. Joiin brings all of that information together, so you can create reports that reflect data from multiple sources.

Join allows you to:

- Craft comprehensive reports on important topics like profit and loss, cashflow and trial balance, and add your own company’s branding to them.

- Report on complex financial situations—where you’re doing business in multiple currencies, or managing two businesses at the same time.

- Consolidate data from multiple accounting platforms, whether you use Xero, Quickbooks, Sage or a bunch of spreadsheets.

9. ChartMogul

Main function: Subscription analytics

If you work for a SaaS (software-as-a-service) company, you’ll be grateful for a tool like ChartMogul. It’s an analytics platform that tracks metrics connected to your subscriptions—so you can understand the user behavior behind your revenue data. It connects to the rest of your tools and billing systems to aggregate subscription data, and feeds it back to you in digestible visualizations.

ChartMogul features include:

- A CRM designed specifically for companies who sell subscriptions, including categories for lead, trial and subscription tier numbers.

- A dashboard to track SaaS metrics across the whole sales funnel, like lifetime value, churn and average order rate.

- Analysis and prediction tools to help you understand the dynamics of your subscription service and model the impact of potential pricing changes.

10. Quaderno

Main function: Tax compliance

Noone loves doing taxes, so it’s no surprise that a tool to reduce tax admin should make an entry on this list. Quaderno is especially useful if you work for an ecommerce company. Since customers can easily buy products online across borders, you may be breaking tax laws without even realizing you’re doing it. Quaderno can:

- Track your international tax liability and alert you when you need to register in a new country—from more than 14,000 tax jurisdictions worldwide.

- Apply tax to your products at checkout automatically, and at the correct local rate.

- Help you file taxes faster by making all the information you need to know easily available, and even putting you in contact with a partnering accounting service.

Choosing software that works hard**

Every tool on this list is well-loved by finance teams. Adopt a few of them, and you’ll save time, whilst simultaneously ensuring your numbers are crunched more accurately.

However, the notion of replacing your tried-and-true processes held in Excel sheets with new SaaS tools can, initially, sound like hard work. If you don’t want to implement every tool on this list right now, the first place to start is with a software management tool like Cledara.

For most companies, software is the second biggest expense after payroll—and for most CFOs, keeping track of software subscription cycles and monitoring usage is one of the biggest headaches. Cledara helps CFOs slash their tech spend by an average of 30%. It also saves finance teams hours of legwork matching up software subscriptions to their relevant payments. In terms of both savings and admin, it’s great value for effort.

.webp)

.webp)