Welcome to the SaaS roundup by Cledara, a monthly dive into the software powering startups and scaleups. We surface insights from the wealth of data at Cledara to give you a leg up in the software decision-making process.

Not sure what we actually do? Get up to speed with help from Oblivious Oscar.

In this edition:

- Plug-and-play AI for startups

- How scaling affects your software spend

- The SaaS Momentum Index

- Bonus: Popular SaaS around the world

Plug-and-Play AI for Startups

Artificial Intelligence (AI) pops up in the news every now and then. You’ve probably seen the latest around OpenAI’s DALL-E 2 or Google's Imagen – new AI tools that can generate almost any image you want in seconds via text.

It’s pretty impressive if you ask us.

But AI isn’t just used by those working at the cutting edge of technology. In the last few years, there’s been a proliferation of software providers integrating AI tech into their product and offering it to everyday companies. With little expertise required to use the tools, AI-powered software is quickly becoming an important part of a startup’s arsenal, and we see this trend in our data as well.

So what exactly is AI, how does it help startups, and what are the most popular AI tools?

What is AI software?

Software that has the ability to mimic human behavior and learning patterns is categorized as AI. Essentially, this category of software is able to learn and improve on its own to deliver better results.

Oftentimes you’ll hear the term Machine Learning (ML) mentioned alongside AI. And while they’re closely related, it’s not entirely the same. ML is a subset of AI, which can be trained to perform tasks better every time. AI goes a step further and uses human learning patterns to independently solve more complex problems.

The ability to think and reason more like humans is a leap forward and means that we can expect better results from the tools that help us be more productive.

How can businesses benefit from it?

AI can be put to use in different ways depending on the requirements and opportunities your startup has. Larger companies leverage AI tools to automate processes and forecast demand, and while there are still challenges to solve, companies are pushing forward and integrating this technology into their daily operations.

Smaller companies are implementing AI tools mainly for process automation, Specifically in the realm of marketing and customer service. This is thanks to improvements in the ability of AI to recognize and deliver sentences more like us humans (instead of the classic robotic text translations).

The benefit of these tools is twofold:

- They deliver better results compared to non-AI tools

- They automate processes that could only be done properly by humans

Here’s an example: AI transcription tools are now able to quickly, and accurately transcribe audio from podcasts or videos.

AI tools on Cledara

We dug into our data to see what type of AI-powered tech is being adopted by startups. Here’s what we see:

There are 25 SaaS tools on our platform that describe themselves as “AI-powered” tools. Now, the caveat is that we don’t always know to what extent these companies are using AI. It could be that it’s not per se full-fledged AI, but they may use machine learning instead – a subset of AI.

By far the most widely used applications on our platform are AI writing assistants, AI video creators, and AI transcription tools. Here are the top 3:

1. Jasper: A GPT-3 AI writing assistant

2. Synthesia: An video creator with AI avatars

3. Descript: An audio and video editor that uses AI to generate voice clones

.png)

Curious to discover more tools like these? Our newsletter will fill you in on the latest “Under the radar SaaS” twice a month. Subscribe here.

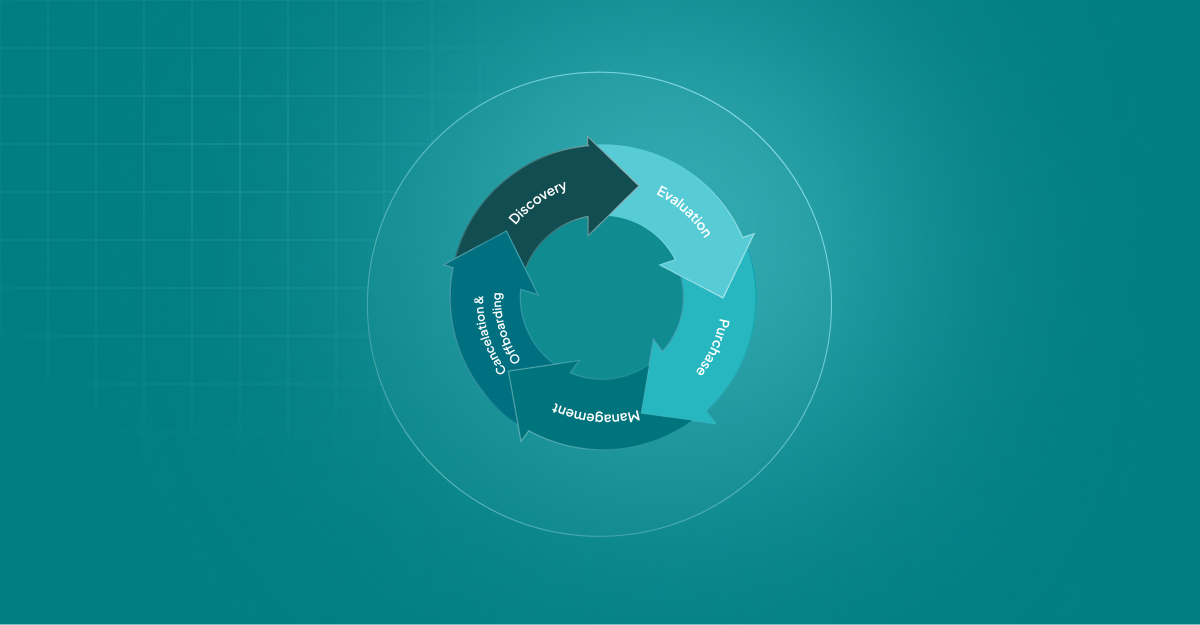

How scaling affects your software spend

With so many new tools (like AI writing assistants) available for companies to onboard at the click of a button, how does that affect software budgets? In July’s edition of the SaaS roundup, we examined our data to understand how startups and scale-ups spread their software budget across teams.

This time around, we wanted to discover how monthly software spending changes when startups scale up into larger companies – think about going from the initial 1 to 9 employees and growing headcount to 50+ employees.

Here’s what we see:

It’s important to note that this increase in monthly spending specifically covers Software as a Service (SaaS) that are onboarded as subscriptions. If you also take into account software or tech that isn’t purchased on subscription, the actual spending may increase much more as startups scale.

This increase in expenses isn’t just related to the number of seats for each tool. As companies scale, their needs require them to use more sophisticated features that are usually offered in higher pricing tiers.

In the previous SaaS Roundup, we provided the example of CRM tools, which can get particularly expensive once you upgrade to the full capabilities of their platforms.

There is also a massive rise in the number of software tools available on the market. In 2020, we had about 70 categories for the software managed on our platform. At this point in 2022, we’re almost at 1,000 categories of SaaS. Since it’s so easy to subscribe to and start using software nowadays, companies are quickly onboarding the latest point solutions to get an edge.

SaaS Momentum Index

Let’s zoom out and take a look at the broader software market with our monthly SaaS Momentum Index. This new index is based on aggregated, anonymized Cledara data that measures overall software spend trends as an indicator of the health of the SaaS market.

When the index rises above 100, SaaS spend momentum gets stronger and when it falls below 100, SaaS spend momentum is weaker as companies are spending less on software than the previous month.

We began tracking the index in January 2021, and it has never gone below 100, which means that on average companies have always increased their SaaS spend. In June 2022, our index was 114.3, on par with May’s 114.1.

Even with Inflationary pressure impacting the economy, a rise in tech layoffs, and industry giants like Notion raising their pricing, there seems to be nothing stopping companies' dependency on software.

Bonus: popular SaaS around the world

If you’ve ever wondered who’s using what software, we aggregated the most popular tools managed on the Cledara platform and examined the most popular across different countries. Take a look and see if your favorite made the list!

Takeaways

There’s so much to discover about the software that powers companies around the world. In the coming months, we’ll continue to share unique SaaS insights to help you make better business decisions.

For now, just remember that:

- Startups are leveraging AI to boost productivity

- Scaling your company means scaling software expenses

- Regardless of the economic circumstances, companies are spending more on software

Drop us a line with any questions, and make sure to subscribe to our newsletter for more insights.

.webp)